For most businesses, the looming new year means that it’s time to start tax planning.

All business owners go through a similar tax planning process, but there are some specific benefits of tax planning for agencies and to reap those benefits, you have to get started right away.

What is Tax Planning?

Tax planning is a combination of strategies to help your business lower it’s tax liability. The key to successful tax planning, which many business owners skip over, is referring to it and checking on progress on (at least) a quarterly basis, not just when each December rolls around.

If you make the mistake of waiting until December, it’s often too late to make the necessary changes.

Let’s say your business is profitable and you are trying to reduce your liabilities. In this case, you are probably searching for expenses you can use before year-end. Laptops that your team needs in 2023 can be bought now to lower this year’s liability.

Working with a CPA will give you the best advantage when it comes to tax planning. It’s their job to analyze your income and create a plan for optimizing your savings. But this isn’t a process that can be done after the fact. You should be working with your CPA around the calendar year to see the best results.

Again, tax planning is all about being proactive. Before this quarter ends, turn to your CPA and look at the items you can do to lower your tax liability.

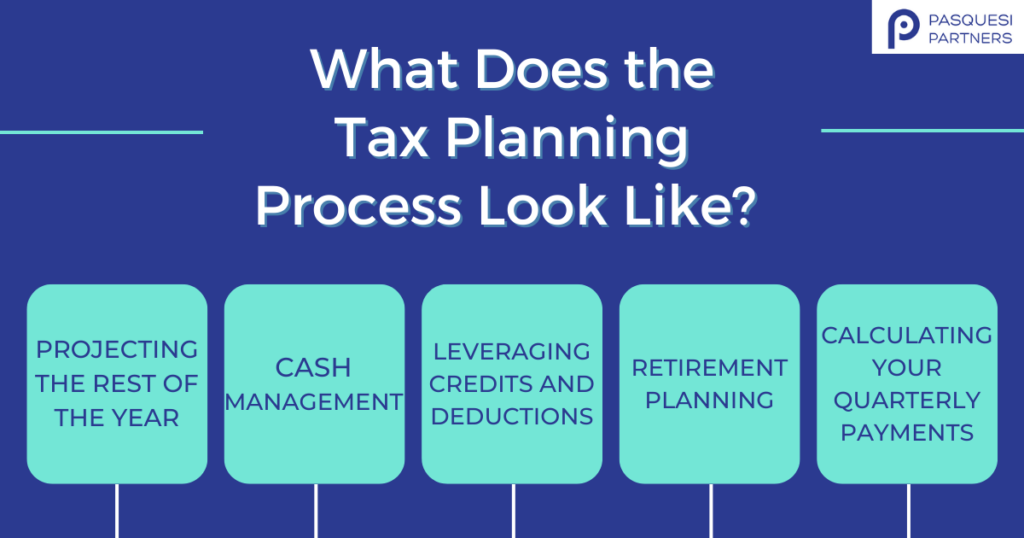

What Does the Tax Planning Process Look Like?

Projecting the Rest of the Year

To get the most out of your tax planning, make sure all of your numbers are up-to-date by reconciling your accounts and ensuring every transaction has been recorded.

With up-to-date numbers, you can build projections and forecasts for what the rest of the year will look like. This will help you make more accurate estimates of your quarterly payments and give you a jump start on the year-end close process.

Cash Management

You can also use these projections to determine if you need to accelerate or defer income. They’ll show you what you will owe if you collect “X”. This information can be vital and will allow you to time your income to your advantage.

As we mentioned previously, tax planning also gives you the opportunity to accelerate expenses. In many cases, it’s advantageous to pile on larger expenses now to lower your taxable income.

For example, paying your annual service charges (like HubSpot) now instead of a few days into the new year will allow you to write off that expense on this year’s taxes rather than the year ahead.

Leveraging Credits and Deductions

At this point in the year, you should be aware of most of the credits and deductions your business plans to claim. However, now is the best time to check in to make sure you are still on track to claim them.

Here are a couple of credits your business could qualify to claim:

- Pass-Through Entity Tax – This is an elective quarterly tax payment for LLC’s, partnership’s, and S-corporations. This helps reduce the profit of the business while simultaneously benefiting the owner of the company.

- R & D Credit – This credit is awarded for investing in qualified research and development activities that drive innovation and growth.

Again, it is essential to keep your books in order. Without organized books, it will be difficult to prove you’ve met the requirements for credits and deductions.

Retirement Planning

Retirement planning is also an essential piece to every effective tax plan because contributions reduce your taxable income.

Whether you are contributing to your own retirement plan or plans for your employees, it’s an effective strategy for lowering your tax bill.

Calculating Your Quarterly Payments

As you know, you have to make quarterly payments throughout the year. There will be a payment that needs to be made on January 15th, but the cycle for that payment ends at the end of December.

This means now is the time to make any necessary adjustments or spending to reduce your profits for the quarter before the end of the year.

We Specialize in Tax Planning for Agencies

Tax planning can be time-consuming and daunting. However, meeting with your CPA on a monthly or quarterly basis will save you time, stress, and money once tax season rolls around.

An experienced CPA will know exactly what to look for and give suggestions for lowering your tax liability, but you have to start now for it to be effective!

If your agency needs help with the tax planning process, consider reaching out to Pasquesi Partners. We work with agencies to help them lower their tax bill and grow their business! Contact us today to learn how we can help you!