Automated bookkeeping and a focus on strategy go hand in hand. Why?

Because strong bookkeeping is the foundation of all of the numbers you need to improve your business and make the right decisions, it has a direct impact on the success or failure of that business. This is why efficient and accurate bookkeeping is essential.

This is where automation comes in. It allows businesses to manage their numbers efficiently and accurately.

In this article, we will discuss:

- The overall purpose and importance of bookkeeping as it relates to strategy

- How automated bookkeeping can benefit your business

- How automated bookkeeping works

- How it can be leveraged to help you and your business make strategic decisions

The Role of Bookkeeping in Accounting

Bookkeeping is the foundation of accounting. At its core, it involves recording financial transactions in a systematic and organized manner.

Bookkeeping provides insight into the overall financial health of the business and provides the information you need to make informed financial decisions. Proper bookkeeping keeps accurate records of income, expenses, and cash flow within the business. Having this data is key when preparing financial statements and for tax purposes.

However, manual bookkeeping can be both a challenging and time-consuming process. It often involves a hefty amount of paperwork and runs the risk of errors and mistakes along the way. In addition to this, manual bookkeeping becomes more and more difficult to keep up with as your business continues to grow.

Benefits of Automated Bookkeeping

Automated bookkeeping makes use of software and technology to record your financial transactions and eliminates the need for manual bookkeeping.

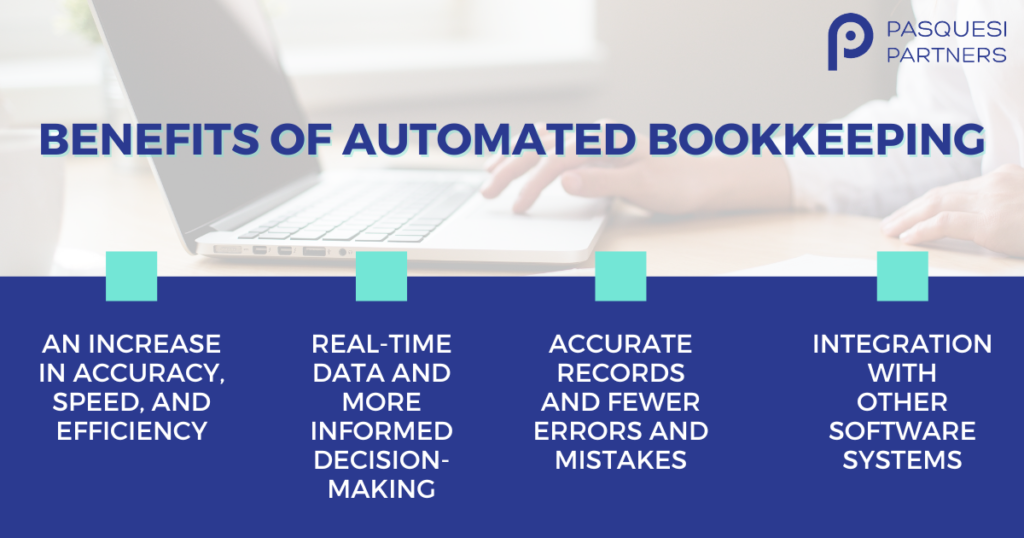

Some of the benefits of automated bookkeeping include:

- An increase in accuracy, speed, and efficiency when compared to traditional bookkeeping methods. This allows for more time to be spent on strategic thinking and analysis for your business.

- Real-time data. This leads to more informed decision-making.

- Accurate records and fewer errors and mistakes in your accounting.

- Integration with other software systems, such as point-of-sale systems and payment gateways, in order to provide a complete picture of your business’s financial health.

How Automated Bookkeeping Works

Automated bookkeeping automates the recording process for your financial transactions and provides real-time data. It typically uses cloud-based software, which allows you to access your financial data at any time from anywhere.

A key benefit in favor of cloud-based accounting software is that it allows for easy and efficient collaboration between team members and accountants. It simplifies the process of sharing financial data and also provides a centralized location for your financial information to be stored and viewed.

Another great aspect is that it can be customized to meet the specific needs of your business. For example, you can set up automatic reminders for invoices and payments and create custom reports to make the analysis of specific financial metrics even easier for your business.

Leveraging Automated Bookkeeping for Strategic Decision Making

Automated bookkeeping provides the resources needed to make quick strategic decisions. Here are just a few examples:

- Cash flow management

- Many businesses, especially startups, often have limited cash flow and need to manage it carefully. Automated bookkeeping can help you keep track of your cash flow in real time, allowing you to make informed decisions about spending and investment.

- Budgeting

- Businesses have to be able to budget effectively to ensure they are allocating resources appropriately. Automated bookkeeping can help track expenses and revenue, allowing you to create accurate and realistic budgets.

- Investor reporting

- This is especially important for startups as they often need to provide regular reports to investors to keep them informed about the company’s financial health. Automated bookkeeping can generate reports quickly and accurately, making it easier for you to provide investors with the information they need.

- Tax compliance

- Businesses need to comply with tax regulations, which can be complex and time-consuming. Automated bookkeeping can help you keep track of your finances and generate the reports you need to file taxes accurately and on time.

- Growth planning

- You need to be able to plan for growth and make strategic decisions about hiring, marketing, and expansion. Automated bookkeeping can provide you with the financial data you need to make informed decisions about growth strategies.

With the efficient and accurate data provided by automated bookkeeping, you can make data-driven decisions and achieve your strategic goals.

Leverage Bookkeeping with Pasquesi Partners

As software and other financial tools have progressed, automated bookkeeping has become the go-to method for your bookkeeping needs. It allows your business to have a centralized financial hub in the cloud and makes it easier than ever to keep track of your finances.

At Pasquesi Partners, we understand the importance of strategic thinking and decision-making in accounting, and we can help your business leverage bookkeeping to make informed decisions and have a long-lasting, positive impact on your business overall.

Our team of experts can help your business set up and customize automated bookkeeping software to meet the specific needs of your business and help you see these great results for yourself. Contact us today to schedule your one-on-one consultation.